Trading, where many are called but few are chosen. Williams emerged as guidance for those navigating the treacherous currents of the stock market. His storied accomplishment of turning $10,000 into $1 million within a single year is not just a testament to his mastery of the market cycles but also a masterclass in strategy, discipline, and insight.

His book, “How I Made One Million Dollars Last Year Trading Commodities,” serves as a seminal work in the field of trading. This article unpacks the vital lessons gleaned from Williams’s journey, offering a roadmap to those aspiring to emulate his success.

Mastering Market Cycles

Williams’s strategy heavily relied on understanding market cycles and seasonal trends. Moreover, he viewed markets as inherently predictable, thus strongly advocating for the recognition of patterns at an early stage. Through his commitment to analyzing historical data, he not only highlighted but also underscored the immense value of pattern recognition in achieving trading success.

The Power of Precision in Trade Entry and Exit

Williams’s success was largely dependent on the meticulous timing of his entry and exit points. Moreover, his proprietary Williams %R indicator played a crucial role in pinpointing overbought and oversold market conditions. By doing so, it not only emphasized but also reinforced the significance of a disciplined approach to trading. As a result, this precision led to achieving higher success rates, demonstrating that making money in trading is not merely about what you trade but also crucially about how and when you trade it.

Risk Management: The Keystone of Trading Success in Market Cycles

Williams’s narrative is not one of unchecked risk but of strategic, well-calculated moves. His ability to turn a modest sum into a fortune within a year was not through relentless risk-taking but through stringent risk management. Williams’s methods teach traders the value of setting strict stop-loss orders and only risking a small percentage of their portfolio on any single trade. This principle ensures longevity in the trading business, emphasizing that preserving capital is as important as growing it.

Harnessing the Psychological Strength: Market Cycles

Success in trading commodities, as Williams’s journey illustrates, is as much about mindset as it is about market analysis. Williams cultivated a psychological resilience that allowed him to detach from the emotional cycles of fear and greed that plague many traders. This mental fortitude enabled him to stick to his strategies even in the face of market adversity, highlighting the critical importance of emotional intelligence in trading.

Education and Adaptation: The Pillars of Sustained Success

Despite his considerable success, Williams never stopped learning and adapting. He understood that the market is a dynamic entity, constantly evolving and shifting. Williams’s commitment to education, through both his victories and defeats, highlights that successful trading requires an ongoing commitment to learning and adaptation. Williams’s career is a powerful reminder that in the world of trading, complacency can be the greatest enemy.

Embracing Innovation: Williams’s Approach to Market Analysis

Larry R. Williams has always been at the forefront of trading innovation, never shying away from the use of cutting-edge technologies and methodologies to gain an edge in the market. He stressed the importance of creating and utilizing innovative tools and indicators to dissect market behaviours and identify trading opportunities. Williams developed several technical indicators that are now staples in many traders’ toolboxes.

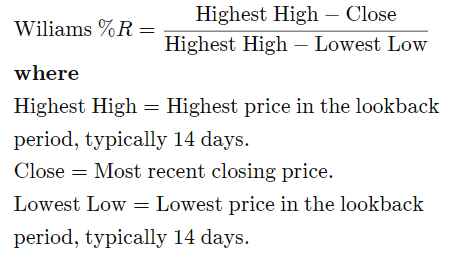

One such tool is the Williams %R indicator, a momentum indicator that compares a stock’s closing price to its high-low range over a specific period. This indicator has proved invaluable in pinpointing market reversals and identifying the best moments to enter or exit a trade.

Williams also advocated for the Commitments of Traders (COT) report as a means to gauge market sentiment and positioning. He interpreted this data to understand the actions of large institutional traders versus small speculators, thus sharpening his strategic decision-making process.

The Formula for the Williams %R Is: (see in more detail here)

Real-World Applications of Larry Williams’s Strategies

The 1987 World Cup Championship of Futures Trading Triumph

Larry Williams’s victory in the 1987 World Cup Championship of Futures Trading stands out as an exemplary case study. In this competition, he astoundingly transformed $10,000 into $1.1 million, achieving an astonishing 11,376% return. Not only did this win cement his status as a trading legend, but it also showcased how effective his strategies could be under high-pressure conditions. Furthermore, this success provides invaluable insights into his approach to risk management, market analysis, and the precision in timing his trade entries and exits.

The Application of Williams %R in Market Analysis

The case study of the Williams %R indicator clearly demonstrates its utility in identifying market reversals. Furthermore, traders have successfully applied this tool across an array of markets including stocks, commodities, and forex, thereby proving its versatility as well as its effectiveness in real trading scenarios.

Incorporating the Commitment of Traders (COT) Report

Williams advocates for the COT report as a sentiment indicator. It shows trader positions, which he interprets for market direction. Traders use this to predict market shifts in commodities, highlighting the benefit of sentiment analysis.

Long-term Success Stories

Beyond just focusing on short-term trades, Williams also placed a significant emphasis on the psychology and strategy of trading. By documenting the journeys of traders over decades, and by observing them navigate through both bull and bear markets, we gain a comprehensive view of the longevity and robustness of his strategies. Moreover, these long-term success stories are absolutely crucial for understanding how discipline, a deep knowledge of market cycles, as well as continuous learning contribute to sustained success in trading.

Words of Wisdom from Larry R. Williams

In addition to his technical acumen, Williams has shared kernels of wisdom that encompass the psychological and practical aspects of trading. Here are a few key takeaways from his wide array of advice when trading market cycles:

Stay Humble: No matter how successful you become, always remember that the market can humble you. This reminder serves to keep overconfidence in check and ensures that traders always approach the market with respect.

Plan Your Trades and Trade Your Plan: Williams emphasizes the importance of having a clearly defined trading plan and sticking to it. This approach helps traders avoid impulsive decisions and maintain consistency.

Learn from Losses: Williams advises traders to view losses as educational expenses. Analyzing and understanding losses is crucial for refining strategies and avoiding future mistakes.

Avoid Overtrading: Patience is crucial. Williams warns against the temptation to trade for the sake of trading, advising instead to wait for high-probability setups aligned with one’s system.

Stay Adaptable: Markets change, and strategies must evolve. Williams champions ongoing research and adaptation as necessary for long-term success.

By combining solid technical analysis with practical wisdom, Larry R. Williams has contributed immensely to the field of trading, and his strategies and teachings continue to guide investors toward the path of financial achievement.

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.

Ever Considered Fine Art as an Investment? See Here