Financial Empires, In the world of financial might and power, few names resonate with the omnipotent clang of the forge like the House of Morgan. A dynasty of banking unlike any other, this colossus has stood as the very embodiment of fiscal strength, ingenuity, and influence, shaping financial empires like few others.

As a modern investor seeking to create your own empire from the broadsheets of economies and the ticker tape of markets, it’s time to stoke the fires and hammer out a strategy on the anvil of endurance that is J.P. Morgan’s legacy.

The Unbreakable Will of the Banking Behemoth: Shaping Financial Empires

At the heart of J.P. Morgan’s supremacy rested an unbreakable will; a stony resilience that anchored the financial titan through tumultuous periods like the Panic of 1907. Investors today must summon a similar resolve. The steel of one’s character is tested in the crucible of market panics, where swift action coupled with confident resolve can calm the maelstrom.

The Sovereign Bond: Trust as Currency

Trust was the sovereign bond trading on the floors of the House of Morgan, a currency more precious than gold. Indeed, investors shape empires when they realize that trust, once forged between advisor and client or buyer and seller, truly becomes the bedrock of sustained growth. Moreover, upholding integrity is not merely noble—it is also an astute strategy for longevity.

The Arsenal of Innovation: Envision the Engine of Growth: Shaping Financial Empires

The Morgans were not just bankers; they were visionaries. From funding railroads to championing the emergence of electricity, the House of Morgan understood that investing in innovation is the engine of growth. Sharpen the arsenal of your own investment philosophy by seeking industries that herald in dawn after economic dawn.

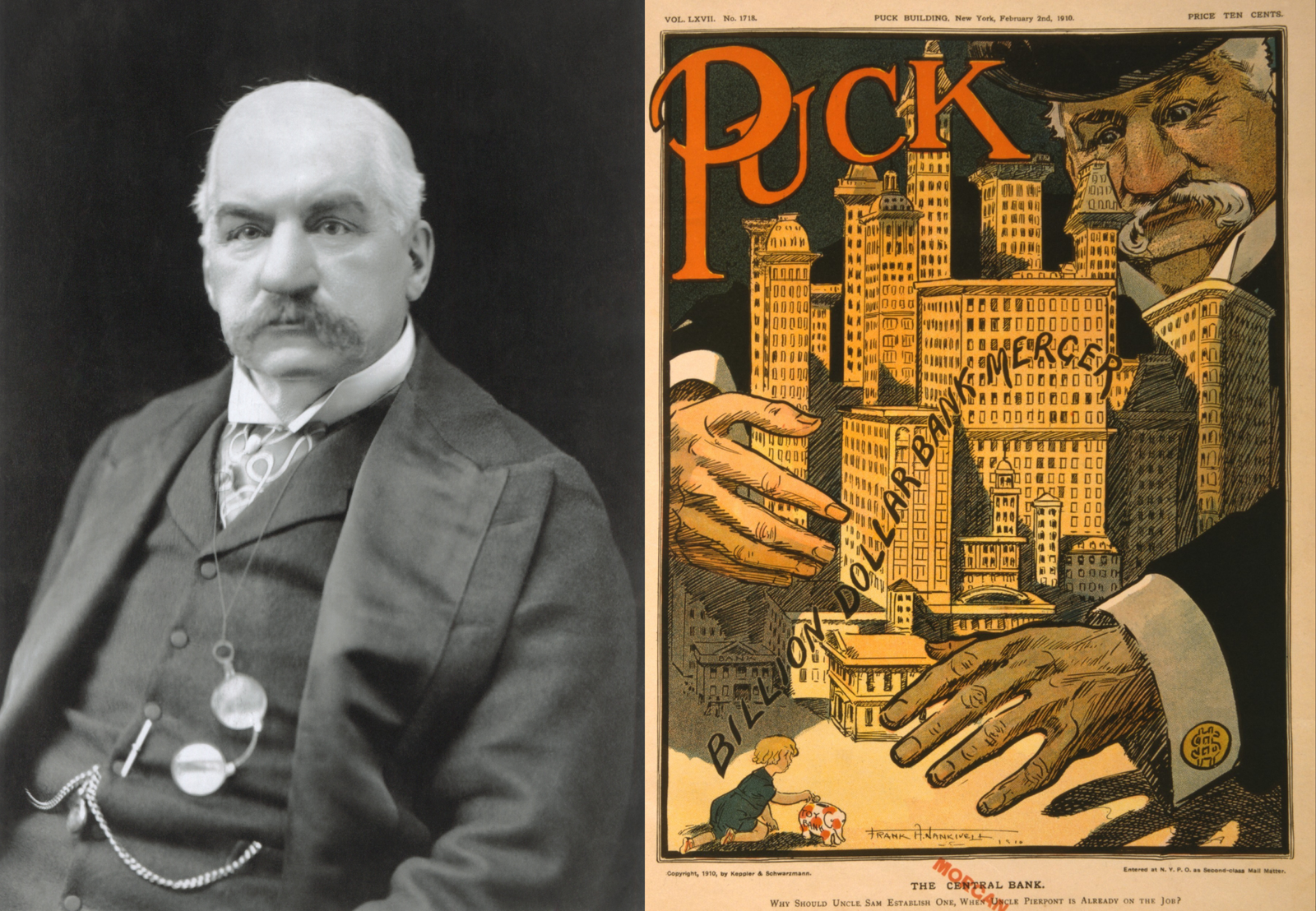

The Art of War and Finance: Mastery over Merger Mania

When battle drums of industry sounded the charge for consolidation, the House of Morgan maneuvered masterfully through mergers and acquisitions. Learn from their tactical play: the art of war in finance means recognizing when to strike, when to merge, and under what banner to unify disparate forces for greater dominion.

The Commanders’ Counsel: Assembling a League of Advisors

Like the knights of the financial round table, the Morgans surrounded themselves with an elite cadre of advisors. Retain and heed a council of economic sages—accountants, financial advisors, legal experts, each with their own experiential arms and armor—ready to aid you in navigating the fiscal fray.

The Siege of Downturns: Fortifying through Diversification

Even the House of Morgan braced for the sieges of economic downturns and depressions. Emulate their prescience by constructing bulwarks around your assets via diversification. This includes a bastion of different asset types, industries, and even geographical exposure, to withstand the volleys of market volatility.

The Vanguard of Reputation: Brandish Your Banner with Prudence

J.P. Morgan’s name carried with it a cachet of solidity and influence. Similarly, investors should forge and brandish their personal or corporate banner with acute prudence. Building a reputation for astute decisions and ethical dealings is like amassing a vanguard of trust that will precede you in all the lands of commerce. This is key in shaping financial empires.

The Chronicler’s Insight: Record the Lessons of History

The Morgans chronicled their ascension alongside the broader swells of financial history, thereby gleaning lessons that would shore up their next endeavor. In like manner, document your own financial journey with the meticulousness of a chronicler; meticulously analyze mistakes, joyously celebrate victories, and draft strategies anew informed by the wisdom of hindsight’s insight.

The Anvil of Persistence: Hammering in the Rhythm of Perseverance

The titan’s anvil of persistence becomes the site where financial legacies are forged. With every strike of the hammer, let perseverance ring out, shaping the metal of your investment strategy with the unyielding beat of unrelenting pursuit.

The Power of Patrician Connections: Networking as a Wealth Multiplier

The Morgans epitomized the notion that who you know can be as crucial as what you know. Embracing this patrician wisdom, you should strive to build a network of influential and knowledgeable contacts. To this end, make it a point to attend industry gatherings, participate in financial forums, and engage in community events where interactions with potential mentors, partners, and clients can occur. Ultimately, the web of a solid network not only serves as a safety net but also functions as a springboard for opportunities.

Financial Statesmanship: Steering the Course of Economies

J.P. Morgan himself acted as a de facto central banker to the United States before the establishment of the Federal Reserve. In fact, he understood that considerable power lies in the ability to steer the course of economies. Therefore, as an investor, your goal should be to understand and potentially influence economic policy and trends. This approach is especially relevant today, given that social media and thought leadership can significantly shape public discourse and policy.

Risk Management: The Morgan Mantle of Caution

Despite their aggressive pursuits, the House of Morgan did not leap blindly into investments. They balanced their daring with a mantle of caution, carefully weighing risks and returns. As an investor, emulate this practice. Consider hedging strategies, insurance instruments, and emergency funds as parts of your investment portfolio to mitigate potential losses.

The Virtue of Philanthropy: Social Capital and Legacy Building

The Morgans were also known for their philanthropic endeavors. This virtue not only serves the public good but also builds an invaluable form of social capital — respect and goodwill that can transcend generations. Consider how your investments can have positive social impacts, from environmental, social, and governance (ESG) strategies to direct charitable giving. This can not only help society but also reinforce the robustness and reputation of your financial empire.

The Digital Dominion: Embracing Technological Disruption

In a modern context, the Morgans would likely have been at the forefront of embracing digital technologies and the disruption they bring to finance. From blockchain and cryptocurrency to fintech innovations, ensure that your investment strategy is not just reactive but proactively seeking out the transformative potential of technology.

Forecasting and Flexibility: The Forecast as Your Financial Frontline

Morgan’s era required a knack for forecasting economic trends, and the same holds true today. Employ data analytics, machine learning, and economic modeling to predict market movements. However, combine these with flexibility—remain nimble enough to pivot strategies as those forecasts evolve and real-time shifts occur.

In homage to the House of Morgan, an institution where the tender of tenacity and the currency of courage saw realms of wealth built and nations fiscally defined, let your own empire be crafted. As an investor, seize your hammer and strike, as the world watches the rise of a new legacy on the mighty anvil of Morgan.

Disclaimer: The insights provided in this discourse draw inspiration from historical financial figures and are designed for educational and inspirational purposes only. Financial investments are fraught with risks that require thorough analysis and often demand professional advice. Past performance is not indicative of future results, and the author assumes no responsibility for any loss or damage arising from reader actions based on the content presented here.