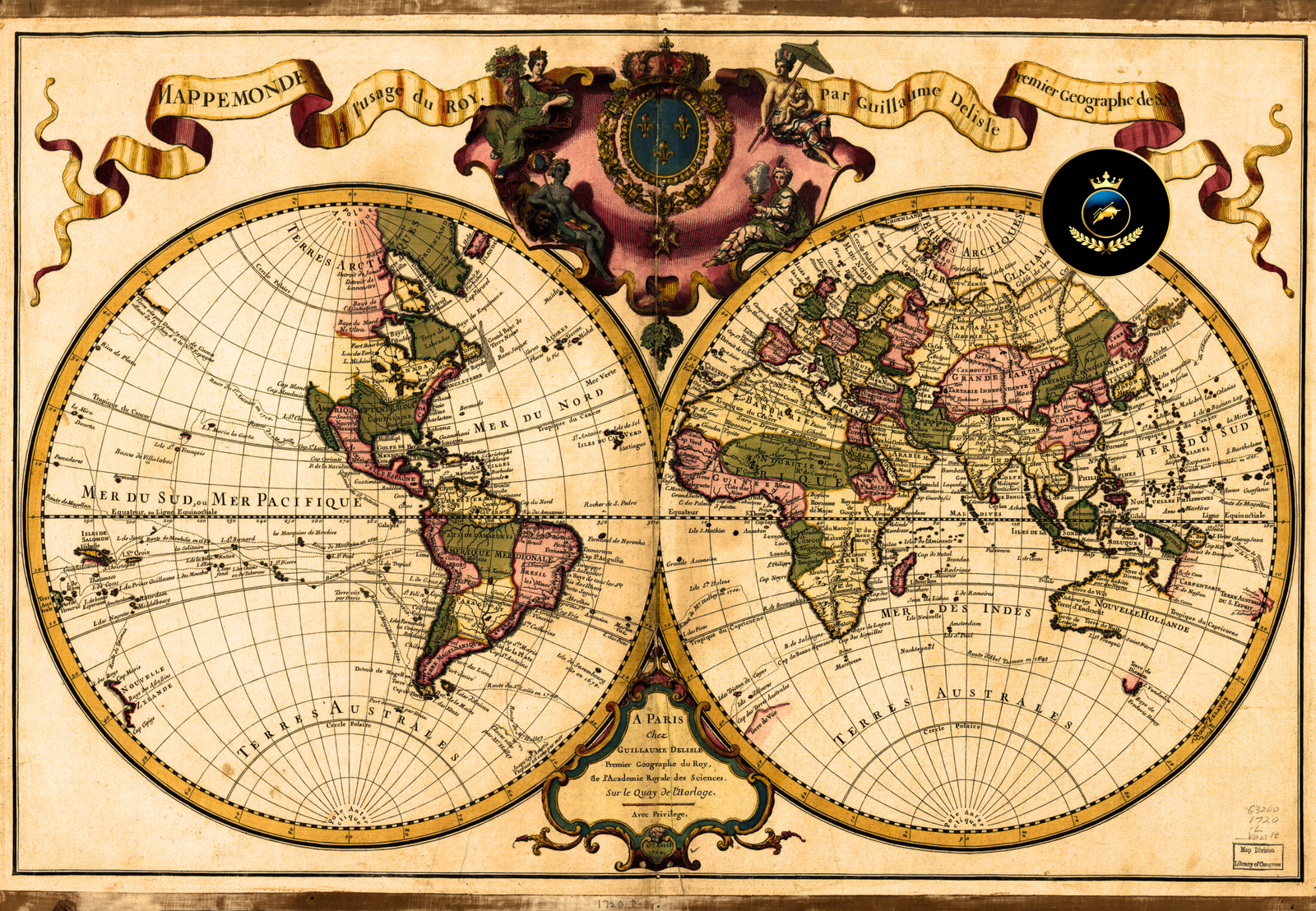

In today’s financial markets, employing Wealth Exploration Tactics is essential for investors aiming to uncover new avenues for growth and stability. These tactics, rooted in both traditional wisdom and contemporary innovation, provide a framework for navigating the complexities of modern investment landscapes.

This era was marked by the enterprising spirits of figures like Christopher Columbus, whose explorations are vividly chronicled in “The Four Voyages: Being His Own Log-Book, Letters, and Dispatches with Connecting Narratives.”

By blending the historical adventures detailed in this compilation with timeless financial principles found in Ben Graham’s “The Intelligent Investor,” we can extract valuable lessons for navigating today’s complex and often tumultuous financial seas.

Modern Tools for Wealth Exploration

Columbus’s meticulous preparations, from securing the necessary backing from the Spanish crown to his careful selection of ships and provisions, underscore the importance of thorough preparation for any venture. Investors can draw a parallel here with the necessity of conducting due diligence before engaging in any financial investment. Understanding the intricacies of the investment, the market conditions, and the potential risks and rewards align with how a navigator prepares for a voyage.

Conduct thorough research on any potential investment, understanding both the specific asset and its wider economic context.

Utilize the right tools for investment, such as financial analysis software, expert consultations, and continuous education.

Managing the Sails in Stormy Weather: Risk Management

Just as Columbus faced unpredictable weather and hostile environments, investors too encounter a landscape marked by volatility and uncertainty. The ability to manage risk, adapt strategies, and stay course during market downturns is crucial. Columbus’s survival depended on his ability to adapt to new challenges—adjusting sail configurations, rerouting, or shoring up resources during unforeseen events.

Diversify your investment portfolio to spread risk across various asset classes and industries.

Establish solid risk management strategies, like stop-loss orders and hedging options, to safeguard your investments.

Leadership and Team Dynamics

Columbus’s expeditions, as chronicled in his own logs, depended heavily on the strength of leadership and the dynamics of his crew. Effective leadership in finance, much like in exploration, involves making informed decisions, maintaining morale, and managing a team. Investor leadership is about portfolio management, decision-making under pressure, and guiding investments toward long-term goals despite short-term fluctuations.

Develop a clear investment philosophy and remain consistent in its application.

Maintain discipline in investment strategy, especially in volatile markets, to ensure decisions are driven by logic and not emotion.

The Long Horizon: Long-Term Planning and Vision

Columbus’s vision extended beyond the immediate horizon to imagined riches and new lands. Long-term planning and having a vision are essential characteristics of successful investing. Investors should develop a vision for their portfolios, setting long-term goals and sticking to a strategy that guides everyday decision-making aligned with these outcomes.

Set clear, long-term financial goals and craft your investment strategy to incrementally achieve them.

Stay informed about global economic trends that could impact long-term investment performance.

The Ethical Compass: Social Responsibility and Legacy

Columbus’s legacy is mixed, marked by both extraordinary geographical discoveries and controversial impacts on indigenous populations. This duality serves as a reminder of the importance of ethical investing. Investors today have the opportunity to choose investments that not only promise financial returns but also positively impact social and environmental factors.

Incorporate ethical considerations into your investment choices by engaging in socially responsible investing (SRI) or environmental, social, and governance (ESG) investing.

Consider the broader impact of your investment decisions on society and the environment.

Expanding Horizons: Embracing Innovation and Continuous Learning

The navigators of the Age of Discovery were entering uncharted territories, often relying on newly developed navigational tools like the astrolabe and the magnetic compass. They pushed the boundaries of known geography, driven by a thirst for knowledge and innovation. This need to innovate and learn is mirrored in the world of investing, where financial instruments, markets, and the methods of accessing these markets are ever-evolving. To succeed, investors must embrace a culture of continuous learning and adaptability.

Stay agile and open to new investment vehicles, such as cryptocurrencies, exchange-traded funds (ETFs), and other financial innovations that may offer strategic advantages.

Invest time in continuous financial education to understand the fundamental and technical aspects of investing. This will allow you to better interpret market signals and trends.

The Mariner’s Fortitude: Dealing with Failure and Uncertainty

Christopher Columbus’s voyages were fraught with challenges. Supplies ran low, crew morale wavered, and at times, it seemed the expeditions might end in failure. Yet, it was Columbus’s ability to persevere through uncertainty and setbacks that ultimately led to his place in history. Similarly, the path of an investor is laden with potential failures and the inevitable uncertainties.

Develop resilience in the face of losses; like a seasoned mariner, learn from mistakes and be ready to chart a new course when necessary.

Practice patience and maintain a long-term perspective, recognizing that even the best investments may go through turbulent phases before yielding returns.

Navigating Ethical Currents: Responsibility and Consequence

While Columbus’s explorations opened up new opportunities and wealth for Europe, they also brought about significant and devastating consequences for the indigenous populations. His legacy offers a stark lesson in the weight of responsibility and the far-reaching impact of one’s actions. Responsible investing considers not only the potential return but also the ethical implications and consequences of investment choices.

Assess the ethical implications of investments and consider their impact on communities, environments, and society at large.

Support ethical companies and initiatives, aligning investments with ventures that prioritize sustainable practices and contribute positively to society.

Harnessing the Winds of Change: Market Trends and Economic Winds

The sailors of the Age of Discovery knew the importance of understanding and harnessing the wind to propel their ships efficiently toward their destination. Similarly, investors need to read the economic winds and market trends to navigate the financial markets successfully. Recognizing and understanding these trends is absolutely essential for anticipating market movements and making informed investment decisions.

To do this effectively, conduct thorough technical and fundamental analysis to spot trends in both the markets and the broader economy.

Moreover, remain adaptable, always ready to pivot your investment strategies in response to the shifting economic winds and trends. This adaptability ensures that you can adjust your sails in the unpredictable financial seas, thereby capitalizing on opportunities as they arise.

Diplomatic Ventures: Collaboration and Networking

Columbus could not have embarked on his voyages without the support of the Spanish crown and the collaboration of his crew. The parallel in the world of investing involves the importance of networking and collaboration. Relationships with financial advisors, fellow investors, and industry professionals can provide valuable insights and opportunities for growth.

Build and nurture a network of experienced investors, advisors, and industry professionals whose insights can provide guidance and open doors to new opportunities.

Collaborate and share knowledge with a community of investors, leveraging collective wisdom to make better-informed decisions.

Charting Unexplored Financial Territories with Wisdom

Drawing lessons from the Age of Discovery, particularly through the gritty and adventurous spirit of Columbus as revealed in “The Four Voyages,” undoubtedly provides a rich playbook for modern investors seeking to navigate the often unpredictable seas of the financial world. Just as the navigators of that pivotal era, today’s investors must thoroughly equip themselves with knowledge, meticulously prepare for their ventures, wisely manage risks, cultivate a leadership style that is both resolute and flexible, and pursue endeavors that aim for profit while also striving for a positive legacy.

By embracing these timeless principles, modern financiaries—now armed with historical insights as well as cutting-edge financial strategies—can effectively explore new realms of wealth-building opportunities. Moreover, they have the potential to make a tangible impact on the world. Indeed, the path to prosperity for the bold investor, much like the path of the explorers, is paved with courage, foresight, and an unwavering commitment to broader horizons.

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.