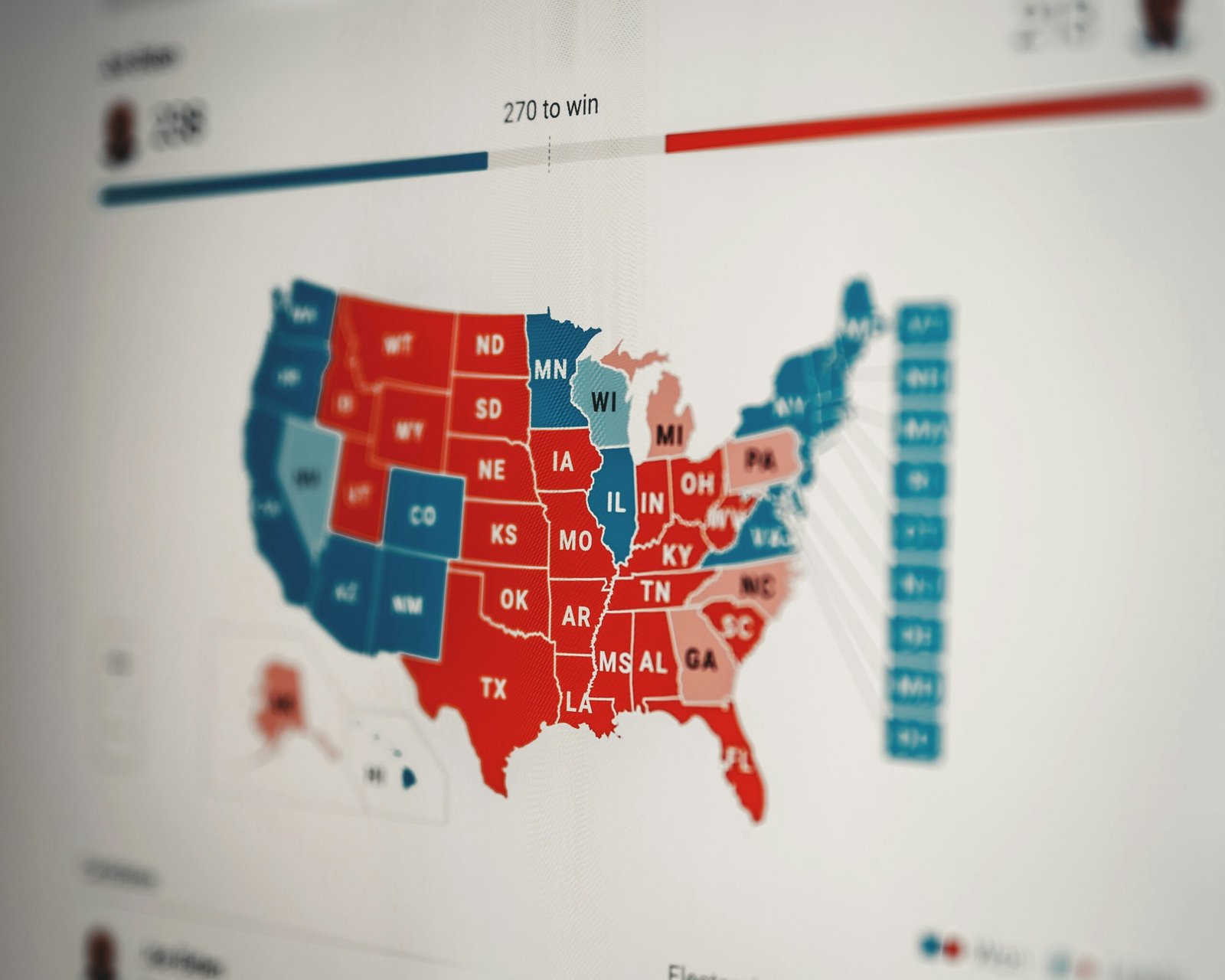

The presidential elections in the United States serve not only as pivotal moments in shaping the nation’s political landscape but also as significant catalysts that influence the performance of both the American and global economies.

The anticipation and aftermath of these elections bring about a period of uncertainty and speculations, as investors and businesses alike try to foresee and adapt to potential changes in economic policies and their implications.

This period of electoral transition has historically seen varied responses from the financial markets, with investment strategies being fine-tuned in response to the perceived economic trajectory under new leadership. Understanding how the world and American economies have historically performed following each presidential election, and how investors align their asset acquisition or liquidation strategies during these times, provides valuable insights into the broader economic implications of political change.

As we look toward the 2024 election, with current President Biden facing challenges within his party, analyzing past trends becomes even more crucial in forecasting what to expect in terms of economic and investment climate shifts.

Economic Performance Post Elections

Over the decades, the aftermath of U.S. presidential elections has largely seen a surge in economic optimism, as businesses and consumers align their expectations with the perceived economic roadmap of the new administration. Traditionally, this is characterized by an uptick in stock market activity and, according to some analysts, a slight short-term boost in GDP growth.

Studies such as the one published by the Booth School of Business at the University of Chicago suggest that since World War II, the U.S. economy has generally performed better under Democratic presidents, with average real GDP growth of 4.6% compared to 2.4% for Republicans.

However, economists caution against attributing economic outcomes solely to presidential policies, citing a complex interplay of factors including global economic conditions, fiscal and monetary policy decisions by Congress and the Federal Reserve, and business cycles that transcend political timelines.

Market Reaction to Election Results

The stock market’s response to election results can provide symptoms of the economys’ health. The S&P 500, for instance, has shown trends of climbing higher in the 12 months following elections, regardless of the winning party—though jumps are sharper typically after a Democratic win. This is partly attributed to investor sentiment drawing from campaign promises of fiscal stimulus and increased government spending, leading to improved corporate earnings and investor confidence.

The American Economy from January Onwards

Analyzing the economic trends from January following an election, we find that the president’s first 100 days can be particularly telling. This period often sets the tone for the administration’s policy approach, impacting consumer sentiment, corporate investment, and economic surroundings. Optimism surrounding new leadership may contribute to increased economic activity, but this can be moderated by legislative realities and the pace of policy implementation.

Investor Behavior Around Elections

In the lead-up to elections, investors traditionally follow a cautious approach. Market volatility often increases during election years due to the uncertainty surrounding policy outcomes. Some investors may choose to hold more cash, divest from riskier assets, or hedge their portfolios against big swings in the market.

Nevertheless, historical analysis shows that markets have a way of smoothing out as actual policies, rather than campaign rhetoric, come into focus. Long-term investors, particularly those with diversified portfolios, typically weather the short-term uncertainty without making substantial changes to their asset allocations.

Following the Election Results

Once election results are clear, investors often move quickly to adjust their strategies based on the perceived policy direction of the incoming president. If policies conducive to growth—such as tax cuts or deregulation—are proposed, equity markets typically respond positively. For instance, the period following President Trump’s election saw significant market growth, attributed by many to his business-friendly promises.

That being said, markets can also react negatively to certain election outcomes, depending on investor sentiment and policy expectations. If the election brings in an administration assumed to increase regulation or raise corporate taxes, for instance, markets might initially respond with caution, as such measures could potentially dampen corporate profits.

What to Expect in 2024

As for the upcoming 2024 elections, where President Biden might be sidelined by his own party due to concerns about his age and vitality, the economic and investment landscape is rife with speculation. With an electorate increasingly attuned to the interplay between politics and market performance, the buildup to 2024 could see investors engaging in a delicate balance between readiness for rapid policy change and maintaining a long-term investment strategy.

Economic Predictions

Predicting the state of the economy post-2024 elections is fraught with uncertainties. However, typical patterns suggest that if a new Democratic president is elected, whom investors perceive as similarly progressive but potentially more dynamic than President Biden, the markets might react favorably to fresh energy and ideas. Should a Republican candidate win, and if their policies favor further tax cuts and deregulation, a similar upswing, as seen in previous Republican wins, could occur.

Who’s Running for President in 2024?

Investment Strategies

Investors might consider positions that could benefit from campaign promises. Clean energy stocks may surge on Democratic wins, whereas traditional energy and financial services might gain from Republican victories.

Moreover, investors are increasingly acknowledging the importance of geopolitical dynamics, technology advancements, and the global interconnection of markets. Therefore, investment strategies leading to 2024 may show greater consideration for international diversification and sectoral shifts that reflect a more holistic view of a changing global economy beyond election cycles.

The performance of both the world and American economies post-elections is influenced by a tapestry of factors that go beyond the political sphere. While historical trends provide some insight into potential outcomes, the increasingly globalized and digitalized world economy is introducing new variables into the equation.

Investors, for their part, are growing more adept at navigating the intersection of political change and economic performance. With the understanding that administration policies can significantly influence market dynamics, investors are likely to continue refining their strategies to best capitalize on post-election shifts—whether that means holding cash reserves, investing in fast-moving sectors, or maintaining a long-term, diversified portfolio approach.

As 2024 approaches, the stakes are high and the economic forecast is inherently speculative. What is certain, however, is that the interplay between election outcomes and economic performance will remain a critical area of focus for investors, policymakers, and citizens alike.

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.

One Response

I was reading through some of your content on this

internet site and I think this site is rattling instructive!

Continue posting.Raise blog range