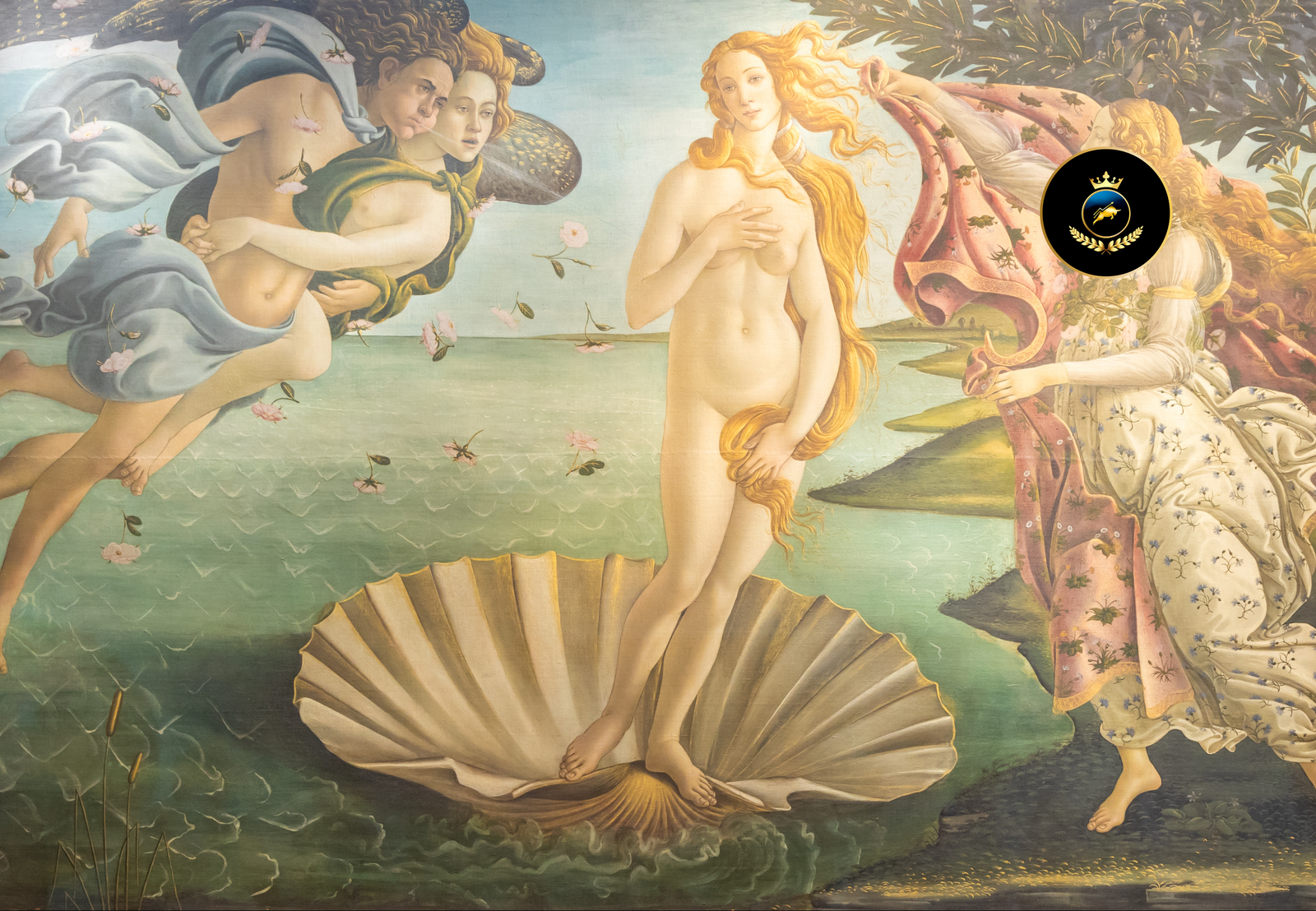

Revived Renaissance, classic investment strategies are being adapted for today’s sophisticated financial landscape, offering investors a blend of historical wisdom and modern application. This article delves into how these time-honored Revived Renaissance Strategies can still provide substantial returns in the 21st century.

Similarly, today’s investor should channel the Revived Renaissance Strategies of innovation, knowledge appreciation, and nimble thinking showcased by the era’s luminaries.

By integrating Jacob Burckhardt’s Renaissance insights with Burton Malkiel’s modern investment strategies, this article pays homage to investors who merge historical wisdom with today’s financial tactics.

The Patron’s Patronage: Investing in Talent and Innovation

In the spirit of the Revived Renaissance, just as the Medici family backed artists, modern investors must identify and support innovative ventures. Backing startups and companies with groundbreaking ideas can yield significant returns, much like the patronage of a da Vinci or Michelangelo.

Revived Renaissance Strategies involve recognizing talent early and nurturing it with patience. Investors should perform meticulous due diligence to discover companies poised for success, before they capture the attention of the wider investment community.

The Cartographer’s Map: Navigating Market Geographies with Precision

Just as cartographers of the Renaissance era improved navigation with more precise maps. This enabled explorers to discover new world. Today’s investor must map the market’s intricate terrains. Understanding the economic landscapes of different sectors and countries allows investors to identify fertile grounds for growth. You should avoid regions fraught with uncertainty.

Ambitious explorers like Columbus changed the world by boldly sailing into unknown seas. Likewise, an intrepid financial journey, supported by comprehensive market research and global diversification, can lead to prosperous discoveries.

The Artisan’s Craft: Mastering Investment as an Art Form: Revived Renaissance Strategies

Renaissance artisans spent years honing their craft, each brushstroke contributing to masterpieces that stood the test of time. The modern investor, too, must view investment as an art, combining analytical skill with the subtler strokes of emotional intelligence and behavioral finance.

As A Random Walk Down Wall Street advises, a successful investor recognizes that markets can be irrational. Craft your investment strategy as an artisan carefully applies their skills, through educated decisions and recognition of market psychology.

The Philosopher’s Quest: Unending Pursuit of Knowledge

The thinkers of the Renaissance, such as Erasmus, emphasized the importance of continuous learning and critical thinking. Investors should embody this philosophical quest for knowledge, always striving to improve their financial acumen and understanding of the investing universe.

Books like Burton Malkiel’s guide offer a sound grounding in investment theory. The wisdom of the Renaissance teaches us that knowledge should never stagnate. Keep abreast of the latest financial theories, market trends, and personal education to maintain a competitive edge.

The Legacy of the Visionary: Renaissance Principles in Modern Wealth Building

Ultimately, Revived Renaissance Strategies guide investors beyond immediate profit, aiming to craft a financial legacy reflective of the Renaissance’s profound legacy.

The Revived Renaissance investor balances speculative gains with capital conservation, echoing the Medicis’ approach, ensuring wealth and positive impact for future generations.

Investing, combining Burckhardt’s Renaissance insights with Malkiel’s market wisdom, requires an artful blend of innovation, risk management, and relentless improvement. Let the Revived Renaissance Strategies of inquiry and discovery steer your investments.

Steps to Consider for Renaissance-Inspired Investing:

Embrace Innovation: Like the patrons of old, invest in companies at the forefront of innovation and change.

Global Understanding: Expand your portfolio on a global scale, recognizing opportunities and risks in various markets.

Continuous Education: Keep learning, studying market trends, history, and investor psychology to adapt your strategy.

Balanced Approach: Combine speculative investments with safer options to create a portfolio that can withstand the tests of time.

And remember, while the Renaissance was a time of opulent artistic expression, its true legacy was the unrelenting pursuit of progress—a principle that should underpin every bold investment choice made today.

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.