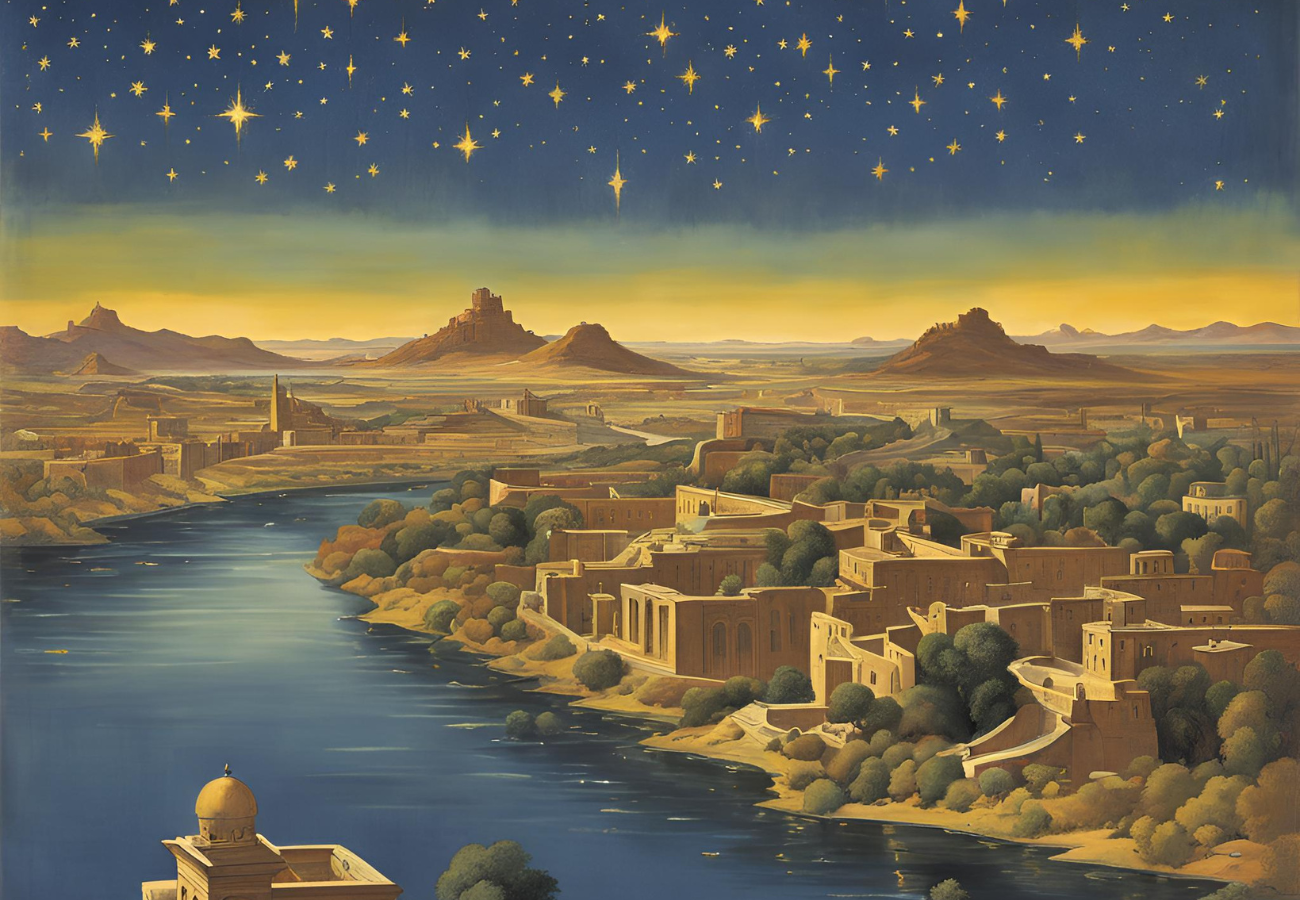

Discover how to build wealth from scratch using proven strategies from the timeless classic, “The Richest Man in Babylon” by George S. Clason. Explore the simple yet powerful principles presented through engaging parables set in ancient Babylon that have helped countless individuals achieve financial prosperity.

Whether you’re starting with little or nothing, this guide provides practical advice and key lessons to help you lay a strong foundation for wealth-building and secure your financial future. Embrace the opportunity to transform your financial status by learning from the wisdom of one of the most influential financial books ever written.

At its heart, the book teaches that financial wisdom and discipline are more valuable than gold. It emphasizes the importance of diligently managing your resources, making informed decisions, and continuously seeking knowledge to grow your wealth.

This foundational mindset is the key to unlocking the secrets of building lasting prosperity from the ground up, ensuring that you are not just wealthy but wise in your financial journey. Below each section is suggestions for potential execution.

Here are key strategies and lessons inspired by “The Richest Man in Babylon” to help you build wealth from scratch.

Start Thy Purse to Fattening

One of the bedrock principles from Clason’s work is: “A part of all you earn is yours to keep.” It is crucial to save at least a tenth of your income. Begin by evaluating your expenses and identifying non-essential costs that can be reduced or eliminated. The money you save from these cuts should be set aside and not touched. This creates a buffer and allows you to slowly but steadily build your financial reserves.

- Direct Deposit Savings: Set up an automatic transfer to a savings account for at least 10% of each paycheck.

- Expense Tracking: Use a personal finance app to categorize expenditures and identify areas for potential savings.

- 52-Week Money Challenge: Save incrementally larger amounts each week for a year, starting with $1 the first week, $2 the second, and so on.

Control Thy Expenditures

Budgeting is fundamental when learning to build wealth. You must understand the difference between necessary expenses and luxuries. Make a list of your essential living costs and ensure they do not exceed 90% of your income. Treat savings as a fixed expense, just like rent or groceries. Discipline in spending is what allows the purse to continue fattening.

- Create a Monthly Budget: Draft a detailed budget that differentiates necessities from luxuries and adhere to it.

- Use the Envelope System: Allocate cash for different spending categories in envelopes, and only spend what’s in each envelope for that category.

- Frugal Living Workshops: Attend free or low-cost workshops on how to live frugally without sacrificing quality of life.

Make Thy Gold Multiply

Saving money is only the first step – the next is to put your savings to work. Clason espouses that your money should be like laborers, working to produce more wealth for you. This can be done through investments. Research and education are crucial here. Consider low-cost index funds or target-date retirement funds as a starting point, if you’re unfamiliar with the stock market. Remember, even the smallest investment begins to compound over time, which is a powerful wealth-building tool.

- Regular Investment Contributions: Open an investment account and start with small, regular contributions to mutual funds or exchange-traded funds (ETFs).

- Free Investment Courses: Utilize free online resources or local community classes to educate yourself on investment basics.

- Join Investment Clubs: Gain insights and tips by joining a local or online investment club where members share knowledge and experiences.

Guard Thy Treasures from Loss

Investing your savings should never be done carelessly. Clason emphasizes the importance of securing the principal investment. This means conducting due diligence and seeking counsel before committing your hard-earned money. Avoid chasing high-return investments that come with equally high risks. Remember the principle: It is better to have a small return than to lose your principal.

- Financial Advisement: Consult with a certified financial planner to assess the risk of different investment opportunities.

- Diversification: Spread your investments across different asset classes to mitigate risk.

- Emergency Fund: Build an emergency fund that covers at least 3-6 months of living expenses to protect against unforeseen losses.

Make of Thy Dwelling a Profitable Investment

Clason highlights the value of homeownership as a means of building wealth. If you’re paying rent, you’re enriching someone else with your hard-earned money. Owning your home not only provides security but can also be a stepping-stone towards further wealth as property values tend to increase over time. Consider saving for a down payment on a property that you can afford, which might also generate additional income if you rent out part of it.

- Home Buyers Classes: Attend classes for first-time home buyers to understand the process and benefits of homeownership.

- Save for a Down Payment: Set up a high-yield savings account specifically for saving towards a home down payment.

- House Hacking: Purchase a multi-family property, live in one unit, and rent out the others.

Ensure a Future Income

Planning for the future is a cornerstone of wealth building. Retirement may seem far away, but starting early makes a tremendous difference. Take advantage of retirement accounts such as 401(k)s or IRAs. The importance of life insurance and wills is also emphasized in Clason’s book. These ensure that your wealth is protected and properly distributed in the event of your passing.

- Retirement Account Contributions: Maximize contributions to retirement accounts like 401(k)s, especially if there is an employer match.

- Life Insurance and Estate Planning: Work with legal and insurance professionals to ensure your wealth is protected and will go to your beneficiaries.

- Side Hustles: Consider developing a side business or freelance work that can provide additional income streams.

Increase Thy Ability to Earn

Investing in yourself is often overlooked but is vital. Education, professional development, and honing of skills all lead to higher income potential. Always seek to improve your worth in the workforce. This could mean taking courses, learning a trade, or starting a side hustle. Motivation and desire far exceed the initial knowledge or money you might have when embarking on your wealth-building journey.

- Continuing Education: Pursue certifications or further education in your field to increase your earning potential.

- Skill Development: Take online courses or workshops to learn new skills that are in demand in the marketplace.

- Networking: Join professional organizations and attend networking events to build connections that could lead to career advancement.

The Five Laws of Gold

In “The Richest Man in Babylon,” Clason presents five laws of gold, which serve as a guide for handling wealth. These laws of gold align with the principles discussed and add additional perspective:

- Gold comes gladly and in increasing quantity to any man who will put aside not less than one-tenth of his earnings to create an estate for his future and that of his family.

- Gold labors diligently and contentedly for the wise owner who finds profitable employment for it.

- Gold clings to the protection of the cautious owner who invests it under the advice of wise men.

- Gold slips away from the man who invests it in businesses or purposes with which he is not familiar or which are not approved by those skilled in its keep.

- Gold flees the man who would force it to impossible earnings or who follows the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investment.

Applying the Wisdom

To apply the wisdom from “The Richest Man in Babylon,” one must start with strong discipline and patience. Wealth-building is a process that often requires time. Avoid looking for shortcuts – instead, focus on making steady, disciplined progress.

- Goal Setting: Set specific financial goals with timelines to keep yourself accountable.

- Patience and Persistence: Recognize that wealth building is a marathon, not a sprint, and maintain consistent effort over time.

Cultivating Discipline and Patience

Wealth is more likely to accrue to those who demonstrate consistent discipline in saving and wisely allocating resources. Patience allows these resources to grow and compound. Moreover, cultivating an attitude of learning from failures and successes alike serves as a strong foundation for any wealth-building endeavor.

- Holistic Financial Planning: Combine investment strategies with a strong understanding of financial psychology to make informed decisions about money management.

- Reflection and Adaptation: Regularly review your financial plan and make adjustments as needed based on changes in your life and financial goals.

Incorporating the teachings of “The Richest Man in Babylon” into your financial life can be transformative. The overarching theme of the book is simple: live within your means, save a portion of your earnings, and invest wisely. Keep educating yourself, and as your resources grow, so too should your responsibility and caution.

By applying these principles, you can initiate a robust plan for wealth accumulation. Start by setting aside at least 10% of your income for savings before you spend on anything else. Next, seek ways to make your money work for you by investing in opportunities with a reasonable expectation of return. And remember, with wealth comes the need for wisdom in managing and protecting your assets. As you gain financial ground, be vigilant against unnecessary risks and stay informed about your investments.

Wealth-building, as guided by “The Richest Man in Babylon,” is not just about accumulating money but also about nurturing a rich perspective on financial stewardship. It encourages an intelligent and thoughtful approach to personal finance, ensuring that your journey towards riches is as rewarding intellectually as it is materially. This doesn’t teach get-rich-quick schemes; it teaches get-rich-surely—and that is a path that’s open to all.

Note: These execution ideas require adaptation to individual circumstances. It’s important to do thorough research and seek professional advice if needed. Remember, the consistent application of these principles over time can lead to the accumulation of wealth.

The Richest Man in Babylon is a 1926 book by George S. Clason that dispenses financial advice through a collection of parables set 4,097 years earlier, in ancient Babylon. The book remains in print almost a century after the parables were originally published, and is regarded as a classic of personal financial advice.

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.