When it comes to crafting your Investment Portfolio Design, balancing risk and reward is crucial. This not only aids in safeguarding your investments but also in maximizing potential returns, tailored to your personal financial goals.

Imagine standing at the summit of financial success, where worries about economic downturns are but distant echoes, and the future gleams with promise and stability.

This reality isn’t a lofty dream reserved for a select few – it’s an attainable goal for anyone willing to follow the disciplined path of strategic investing.

With keen insight and prudent planning, you too can harness the power of a diversified and balanced portfolio, mirroring the methods that wealth-laden individuals employ to not just preserve but magnify their fortunes.

Investment Portfolio: Balancing Risk and Reward in Design

Before delving into the specifics of asset allocation, it’s essential to understand the mindset that drives successful investors. Wealthy individuals view their portfolios not just as repositories of wealth but as dynamic ecosystems that require regular nurturing, balance, and strategic foresight.

The true essence of wealth does not solely lie in monetary abundance but in the art of sustaining and growing that wealth through intelligent diversification. As Benjamin Graham wisely advised, “The essence of investment management is the management of risks, not the management of returns.”

Core Components of a Wealthy Individual’s Portfolio: Investment Portfolio Design

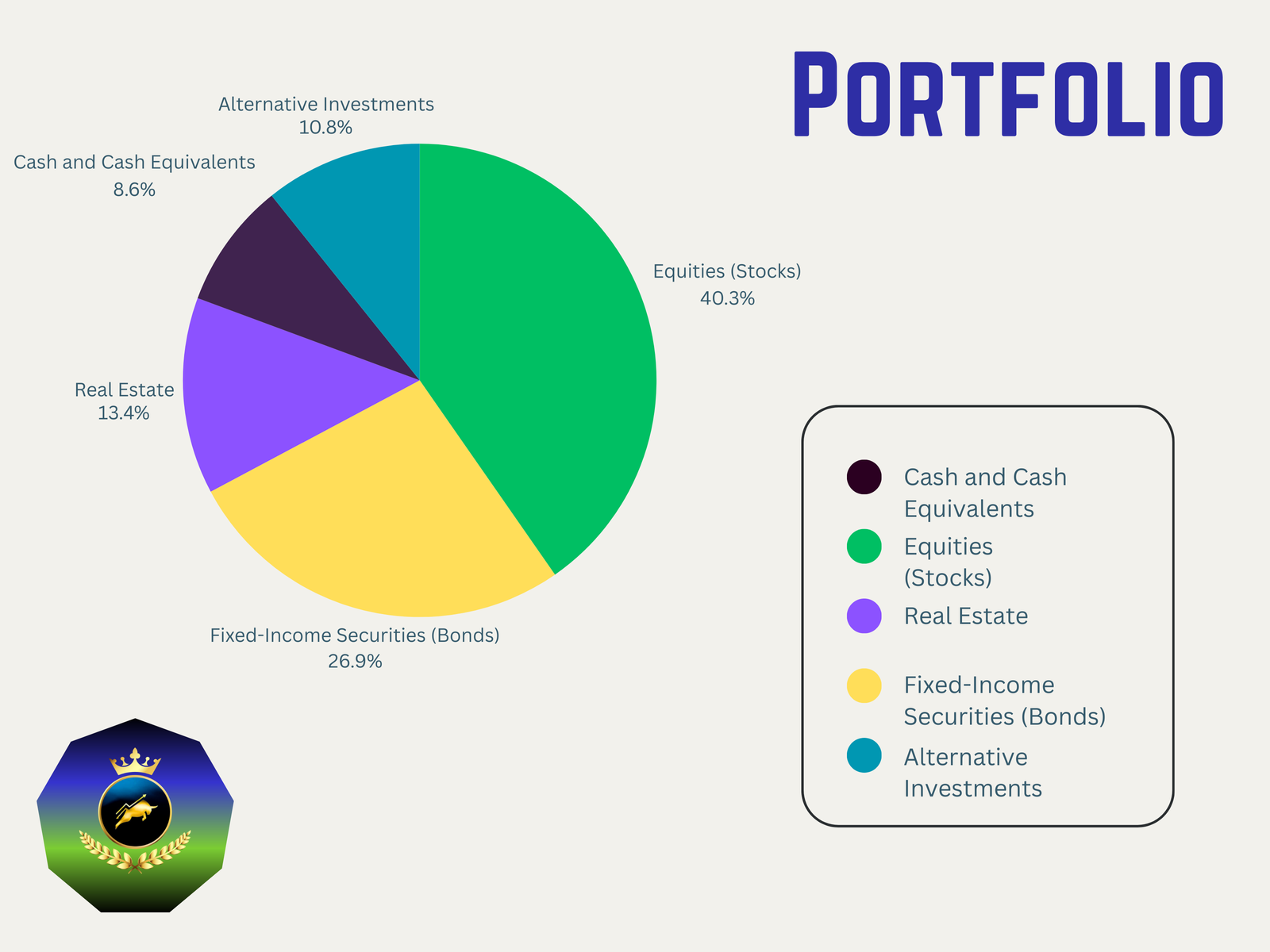

Equities (Stocks) – 40% to 60%

Equities, or stocks, form the backbone of most affluent investment portfolios. They are crucial for growth, given their potential for high returns, albeit with higher risk. Seasoned investors allocate 40% to 60% of their portfolios to stocks. The primary goal is to invest in a diversified mix of domestic and international equities to capitalize on global growth opportunities while mitigating risks associated with any single market.

Key Strategies:

Blue-Chip Stocks: These are shares in large, stable companies with a track record of reliable performance.

Emerging Markets: Investing a portion in developing markets adds potential for high returns due to economic acceleration.

Sector Diversification: Spread investments across different sectors (technology, healthcare, energy) to avoid overexposure in one area.

Fixed-Income Securities (Bonds) – 20% to 40%

Bonds provide a steady stream of income and act as a stabilizing force within a portfolio. Wealthy investors allocate 20% to 40% of their portfolios to bonds, appreciating their lower risk compared to equities and their role in preserving capital.

Key Strategies:

Government Bonds: These are low-risk investments backed by national treasuries.

Corporate Bonds: These offer higher yields compared to government bonds but come with a higher risk.

Municipal Bonds: These are often tax-exempt, providing tax-efficient income streams.

Real Estate – 10% to 20%

Real estate plays a pivotal role in the portfolios of wealthy individuals, indeed, offering both income and appreciation. Moreover, around 10% to 20% of a high-net-worth individual’s portfolio is often dedicated to real estate investments. This allocation reflects a strategy of balancing the tangible asset’s stability with the potential for significant value growth.

Key Strategies:

Direct Ownership: Investing in rental properties provides steady income and potential for growth.

Real Estate Investment Trusts (REITs): These are more liquid options that allow investors to gain exposure to real estate without direct property management.

Alternative Investments – 10% to 15%

Alternative investments are crucial for risk management and portfolio diversification. Wealthy investors typically allocate 10% to 15% of their portfolios to alternatives, tapping into their often low correlation with traditional markets. These investments can offer unique opportunities to enhance portfolio returns and manage risks, as they behave differently from conventional assets like stocks and bonds.

Key Strategies:

Private Equity: Investing in early-stage startups (venture capital) or established companies under reorganization (buyouts) can carry higher risk but offers substantial return potential. For example, investing in a promising fintech startup or a biotech firm on the cutting edge of medical research. Getting involved early would be excellent for a great investment portfolio design.

Commodities: Precious metals like gold and silver, energy resources like oil and natural gas, and agricultural products such as corn and wheat can all serve as a hedge against inflation. This includes purchasing gold to safeguard against economic instability or investing in futures contracts for energy commodities.

Hedge Funds: Investing in public facilities (infrastructure) or natural resources like forests and farmlands can provide steady cash flows and inflation protection. Examples include an infrastructure fund focused on renewable energy projects or shares in a timber company.

Cash and Cash Equivalents – 5% to 10%

Liquidity is king, indeed, and wealthy investors routinely keep a portion of their wealth in cash or cash equivalents. By allocating 5% to 10% of their portfolio to these assets. They ensure that they can quickly capitalize on new opportunities or meet unexpected financial needs without the necessity of liquidating other investments.

Key Strategies:

Money Market Funds: These provide liquidity and a modest return.

Certificates of Deposit (CDs): These are low-risk options that offer higher returns than traditional savings accounts.

High-Interest Savings Accounts: These accounts allow easy access while still providing a respectable interest rate.

The Guiding Principles of Asset Allocation

The principles of asset allocation, as discussed in “All About Asset Allocation,” go beyond mere numbers and percentages; they delve into the philosophy of investment discipline:

Risk Management

Wealthy investors meticulously manage risk through diversification. By spreading investments across various asset classes, sectors, and geographical regions, they reduce the potential impact of volatility in any one area.

Regular Rebalancing

Wealthy investors regularly assess and rebalance their portfolios. They do this to align with their long-term goals and market conditions, ensuring their asset allocation remains within the desired risk tolerance.

Long-Term Perspective

Patience and long-term vision are defining traits of affluent investors. They resist the urge to make impulsive decisions based on market fluctuations, focusing instead on strategies that will yield benefits over the long haul.

Tax Efficiency

Strategies that maximize after-tax returns are critical. This includes tax-loss harvesting, investing in tax-advantaged accounts, and selecting tax-efficient investment vehicles.

Embarking on Your Path to Wealth

Crafting a prosperous future begins with adopting the right mindset and strategies. The route to financial stability and growth is paved with disciplined diversification, thoughtful risk management, and an unwavering long-term perspective.

By constructing a portfolio that includes equities, bonds, real estate, alternative investments, and cash equivalents, you lay a solid foundation for enduring prosperity.

The journey of wealth accumulation and preservation does not end at a particular financial milestone; rather, it is an ongoing process of learning, adapting, and growing. As you embark on this path, remember that true wealth is not just a measure of monetary value but a testament to your ability to make informed, strategic decisions that resonate with your financial aspirations. Embrace the journey, trust in your strategy, and let your wealth be both security and opportunity for generations to come.

Check out if your Personality Type can help you with Investing here

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.