Mastering Hold & Sell in Stocks is essential for navigating the volatile currents of the stock market. This guide delves into strategic decision-making, combining patience with tactical acumen to protect and grow your wealth.

Understanding the Hold: The Power of Patience

Holding onto investments requires a sage-like patience. Just as a gardener nurtures a garden, knowing when to let plants grow, investors should recognize when their investments need time to mature.

When to Hold: Reading the Signs

Professional Insight: Always diversify. Holding strong stocks while spreading investments across sectors reduces risk.risk.

Solid Fundamentals: Companies with strong financials and competitive advantages often warrant holding. Market volatility doesn’t affect their long-term potential.

Sectoral Tailwinds: Investing in sectors with long-term growth prospects, like technology or renewable energy, can justify holding strategies.

Dividend Yields: For those seeking income, stocks with consistent dividends are prime candidates for holding.

The Art of the Sell: Strategic Exit: Mastering Hold & Sell in Stocks

Selling at the right time is key to investment success. Here’s when to consider selling:

Valuation Extreme: Sell when a stock’s price no longer aligns with its fundamentals.

Fundamental Shift: Changes in a company’s core operations or external environment might necessitate selling.

Better Opportunities: If another stock offers better growth potential, reassess your current holdings.

Goal Alignment: Sell when stocks meet your financial objectives to lock in gains.

Professional Insight: Use stop-loss orders to automate selling decisions, protecting against significant losses.

The Danger of Going All In: The Rule of Moderation

Diversification is your safety net. Limit single investments to avoid substantial portfolio damage from one bad pick.

Developing an Ironclad Strategy: The Roadmap to Wealth

Conduct Thorough Research: Use platforms like Seeking Alpha for in-depth analysis.

Set Clear Investment Criteria: Define what makes a stock worth holding or selling.

Cultivate Emotional Discipline: Base decisions on strategy, not emotion.

Embrace Continuous Learning: Stay updated with market trends and economic indicators.

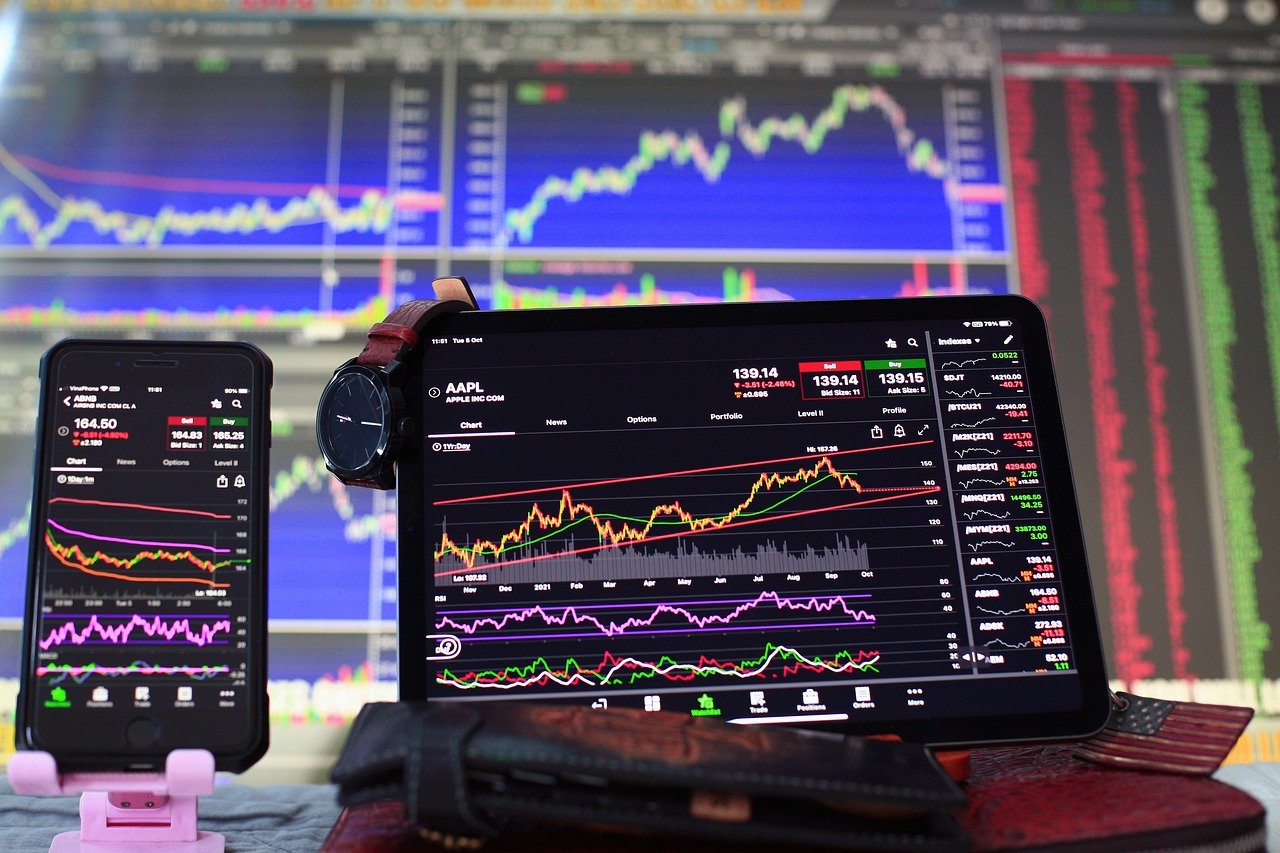

Leverage Technology: Utilize investment tools and apps for real-time data and better decision-making.

Professional Insight: Consider financial advisors or robo-advisors for personalized strategy execution.

Embracing Compounding: The Path to Generational Wealth

Compounding is about earnings generating earnings. Here’s how to harness it:

Start Early: The sooner you invest, the more time compounding has to work.

Regular Investments: Consistent contributions amplify compounding effects.

Reinvest Dividends: Reinvesting can significantly increase your investment growth.

Stay Invested: Patience in reinvestment allows compounding to work its magic over years.

The Strategy of Champions

Mastering when to hold or sell involves a blend of patience, strategic insight, and discipline. Indeed, by concentrating on fundamental analysis, setting clear investment goals, and managing risks, investors can navigate the market more effectively.

Consequently, remember that wealth in stocks grows not from sporadic wins but rather through consistent, well-thought-out decisions that compound over time. Therefore, embrace this dual art, and you’ll approach the market with the wisdom of a seasoned investor. In essence, this balanced approach will serve as your compass in the often tumultuous world of stock investing.

Thinking about Alternative Investments? See Here

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.