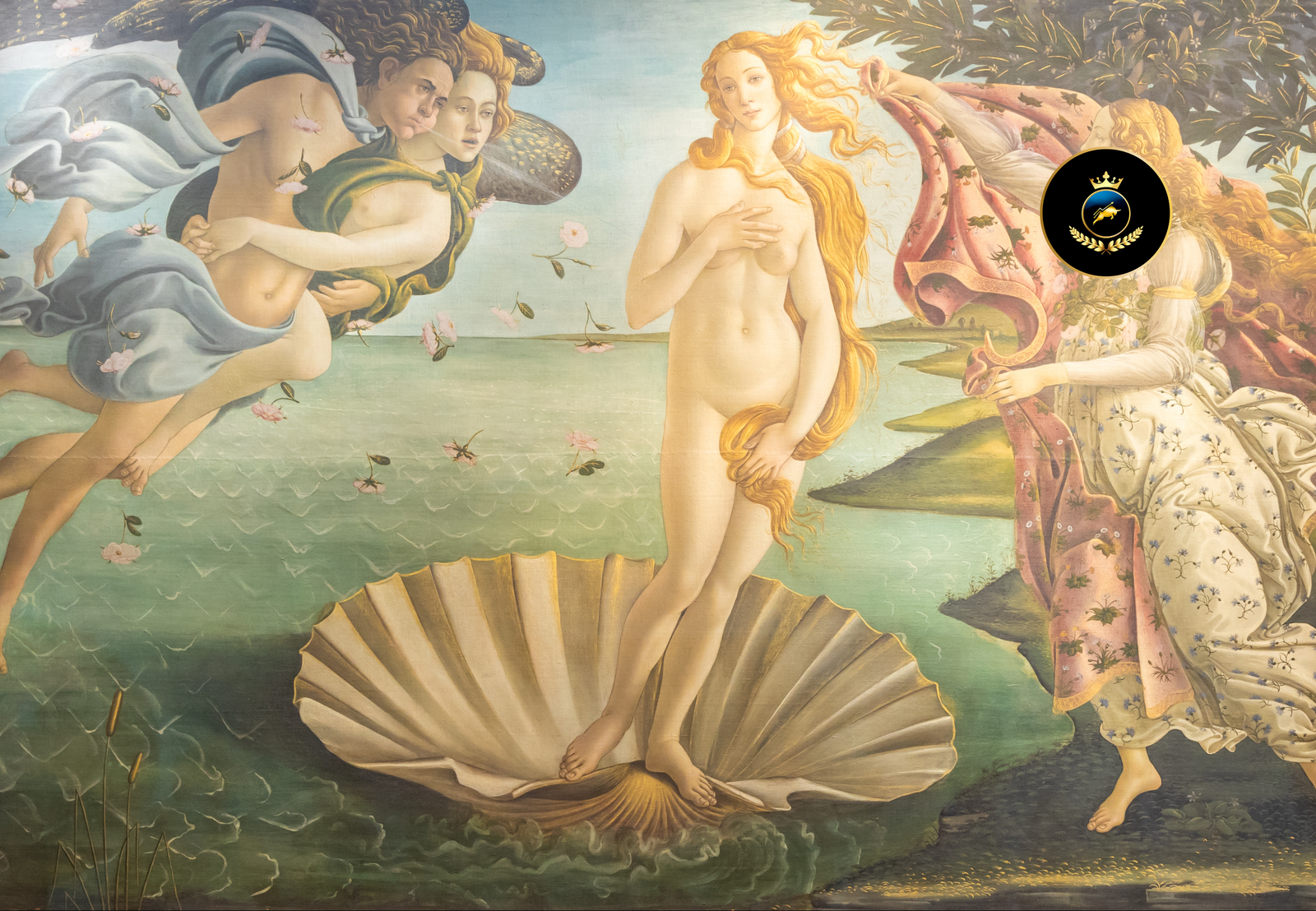

In history, the Renaissance is revered as an epicenter of cultural, artistic, and intellectual rebirth—a time that shook the foundations of the old world and painted the canvas of modernity.

Likewise, the contemporary investor must embody the spirit of innovation, an appreciation for knowledge, and the agility of thought once championed by the luminaries of this transformative era.

Drawing inspiration from Jacob Burckhardt’s classic The Civilization of the Renaissance in Italy and marrying it with the investment principles delineated in Burton Malkiel’s A Random Walk Down Wall Street, this narrative is an ode to those investors who seek to blend timeless wisdom with cutting-edge financial practice.

The Patron’s Patronage: Investing in Talent and Innovation

During the Renaissance, affluent patrons like the Medici family sponsored artists and thinkers, investing in human creativity and genius. Today, an investor must similarly recognize and financially support emerging talent and innovation. Investing in trailblazing companies and startups, akin to sponsoring a da Vinci or a Michelangelo, can lead to substantial returns as their creations reshape the world.

The patron recognized talent early and supported it patiently. Similarly, investors ought to conduct thorough due diligence to spot companies with strong potential well before they become the darlings of mainstream investors.

The Cartographer’s Map: Navigating Market Geographies with Precision

Just as cartographers of the Renaissance era improved navigation with more precise maps, enabling explorers to discover new worlds, today’s investor must map the market’s intricate terrains. Understanding the economic landscapes of different sectors and countries allows investors to identify fertile grounds for growth and avoid regions fraught with uncertainty.

Ambitious explorers like Columbus changed the world by boldly sailing into unknown seas. Likewise, an intrepid financial journey, supported by comprehensive market research and global diversification, can lead to prosperous discoveries.

The Artisan’s Craft: Mastering Investment as an Art Form

Renaissance artisans spent years honing their craft, each brushstroke contributing to masterpieces that stood the test of time. The modern investor, too, must view investment as an art, combining analytical skill with the subtler strokes of emotional intelligence and behavioral finance.

As A Random Walk Down Wall Street advises, a successful investor recognizes that markets can be irrational. Craft your investment strategy as an artisan carefully applies their skills, through educated decisions and recognition of market psychology.

The Philosopher’s Quest: Unending Pursuit of Knowledge

The thinkers of the Renaissance, such as Erasmus, emphasized the importance of continuous learning and critical thinking. Investors should embody this philosophical quest for knowledge, always striving to improve their financial acumen and understanding of the investing universe.

Books like Burton Malkiel’s guide offer a sound grounding in investment theory, but the wisdom of the Renaissance teaches us that knowledge should never stagnate. Keep abreast of the latest financial theories, market trends, and personal education to maintain a competitive edge.

The Legacy of the Visionary: Renaissance Principles in Modern Wealth Building

Ultimately, the pursuit of investing is not merely for immediate profit but for creating a financial legacy that mirrors the enduring impact of the Renaissance’s most brilliant minds.

The Renaissance investor knows to balance the pursuit of speculative gains with the conservation of capital; like the Medicis, they aim not only for wealth but for an enduring positive influence, ensuring that their portfolio serves both their immediate needs and the prosperity of future generations.

Investing, as Burckhardt’s Renaissance and Malkiel’s market wisdom suggest, call for a seamless blend of art and science—a medley of innovation, risk management, and an unquenchable thirst for improvement. Let the Renaissance spirit of inquiry and discovery guide your investment decisions and inspire your actions.

In doing so, may you find your fortunes bolstered not by chance but by the enlightened embrace of a Renaissance thinker, combined with the foresight of a modern investor, ready to compose your chapter in the annals of financial success.

Steps to Consider for Renaissance-Inspired Investing:

Embrace Innovation: Like the patrons of old, invest in companies at the forefront of innovation and change.

Global Understanding: Expand your portfolio on a global scale, recognizing opportunities and risks in various markets.

Continuous Education: Keep learning, studying market trends, history, and investor psychology to adapt your strategy.

Balanced Approach: Combine speculative investments with safer options to create a portfolio that can withstand the tests of time.

And remember, while the Renaissance was a time of opulent artistic expression, its true legacy was the unrelenting pursuit of progress—a principle that should underpin every bold investment choice made today.

Disclaimer: The information provided here is for educational purposes only. It does not constitute investment advice or a guarantee of performance. Investing involves risks, including the possible loss of capital. Seek advice from financial and tax professionals tailored to your financial circumstances and goals.